A Maryland Car Accident Lawyer Who Fights for Victims Injured by Another’s Negligence

Get a trusted personal injury attorney to stand up and protect your rights

If you’ve been injured in a car crash in Maryland or the Washington D.C. area, getting an accomplished car accident lawyer who can fight for you and knows the insurance process inside and out can make a real difference.

After an accident, you will suddenly be faced with medical bills, lost wages, doctor and therapy appointments, and pain and suffering ─ not to mention the stress and pressure of keeping up with your daily life (family, friends, work). This places an entirely new level of burden and frustration on you, and in many cases, your loved ones – to care for you and take on additional responsibilities, that only serve to create more chaos and stress in our already hectic lives.

Our firm’s job one is to help take away the burden and chaos while you recuperate. That means getting the information needed to properly investigate your accident and, more importantly, deal with the insurance company and claims personnel who will be contacting and pressuring you over your case.

To an insurance company, you’re nothing more than a number and a cost that impacts their bottom line, and they’ll do everything they can to pressure you and pay you as little as possible for your injuries and losses, if they pay you at all. They are not on your side and you are not in good hands. The red tape and forms, not to mention their haggling, only adds to your stress and chaos when you are most vulnerable. That’s when an accomplished personal injury attorney can make a real difference.

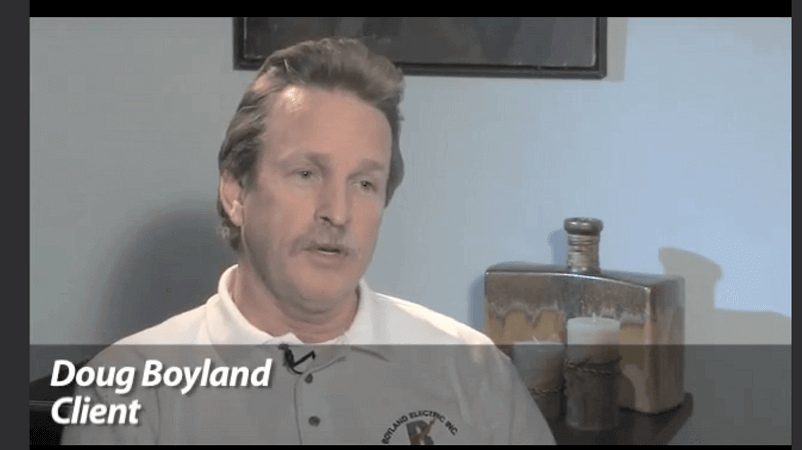

Attorney Stuart L. Plotnick is a professional and experienced car accident lawyer in Maryland who fights for clients hurt in car accidents and will stand by your side, every step of the way. Attorney Plotnick has recovered millions for injured accident victims and knows what it takes to build a winning a case. Contact the Law Offices of Stuart L. Plotnick today for a free consultation.